Why Are Connectors the Backbone of New Energy Vehicles?

In the fast-evolving world of new energy vehicles (NEVs), batteries and motors often steal the spotlight. Yet, connectors—the critical links for power and signal transmission—are quietly driving this transformation. With global EV sales surpassing 14 million units in 2023 (IEA forecast), the shift to 800V architectures and L3+ autonomous driving is placing unprecedented demands on these components.

How are connectors adapting to deliver efficient energy transfer and handle massive data flows? This article dives into the trends shaping NEV connectors—high voltage and intelligence—unpacking their technical evolution and forecasting what’s next.

High-Voltage Connectors: Powering the 800V Revolution

1. The 800V Shift: Boosting Charging and Range

Gone are the days of 12V/24V systems in conventional vehicles. NEVs have moved from 400V to 800V platforms, slashing charging times and extending range. The 800V architecture pushes charging power beyond 400kW, cuts heat loss by about 30%, and reduces harness weight by roughly 40% (industry estimates). This tackles range anxiety head-on—an issue still plaguing EV adoption. Leading OEMs like Hyundai-Kia, BYD, and Tesla are rolling out 800V models, while supercharging networks expand to match. High-voltage connectors are the linchpin, linking batteries, motors, inverters, and charging ports with robust, safe performance.

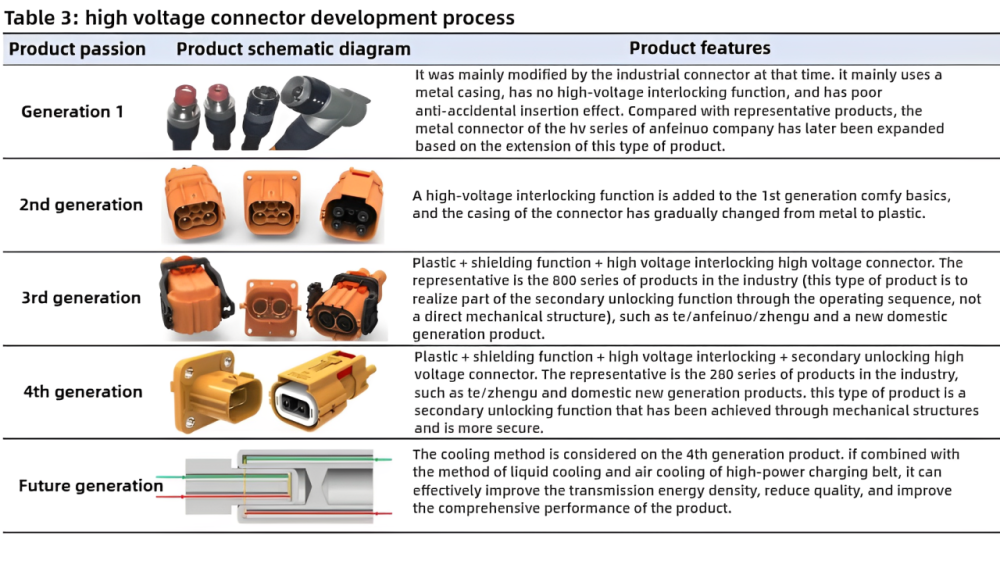

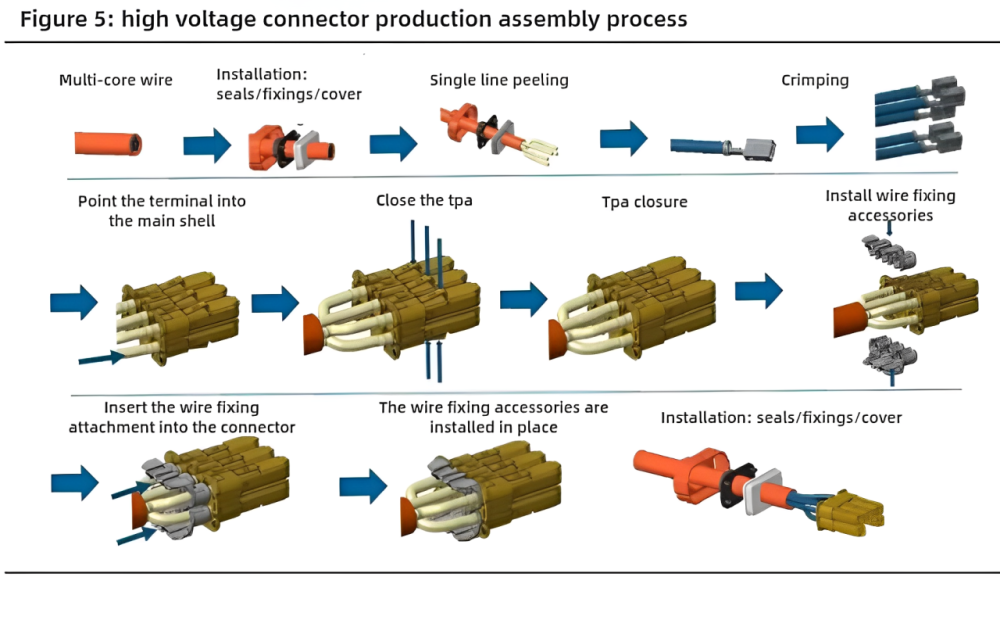

2. Technical Evolution: Safety Meets Efficiency

High-voltage connectors have come a long way. First-generation designs borrowed from industrial applications, but today’s fourth-generation models feature advanced safeguards: High-Voltage Interlock Loops (HVIL) use low-voltage signals to manage high-power circuits, while secondary locking (CPA/TPA mechanisms) prevents accidental disconnection. These connectors handle 600V+ and hundreds of amps, with shielding to curb electromagnetic interference. Market analysts project the high-voltage connector segment to hit $3 billion by 2025, growing at over 15% annually, as liquid-cooled charging guns emerge to support ultra-fast charging.

Smart Connectors: Pioneering Data for Autonomy and Entertainment

1. Rising Data Demands

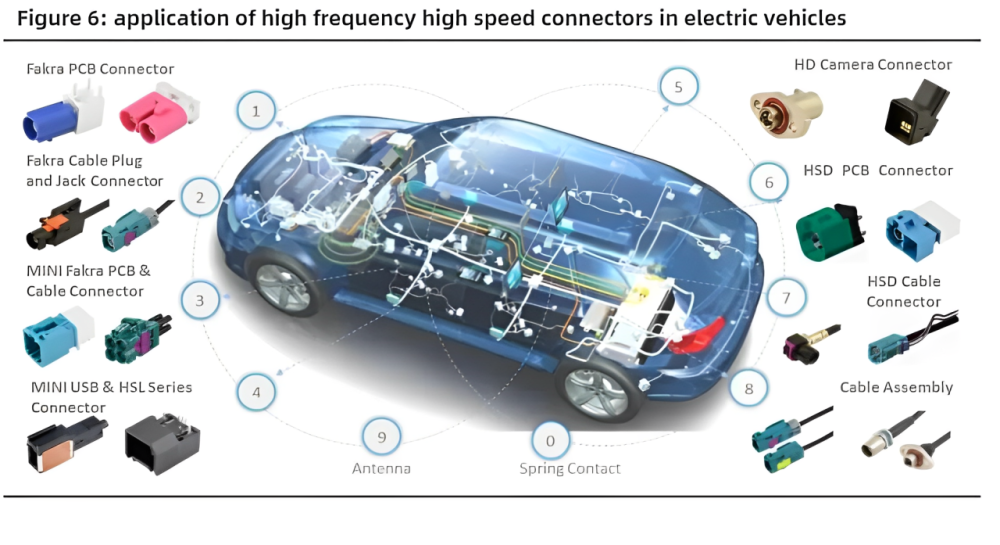

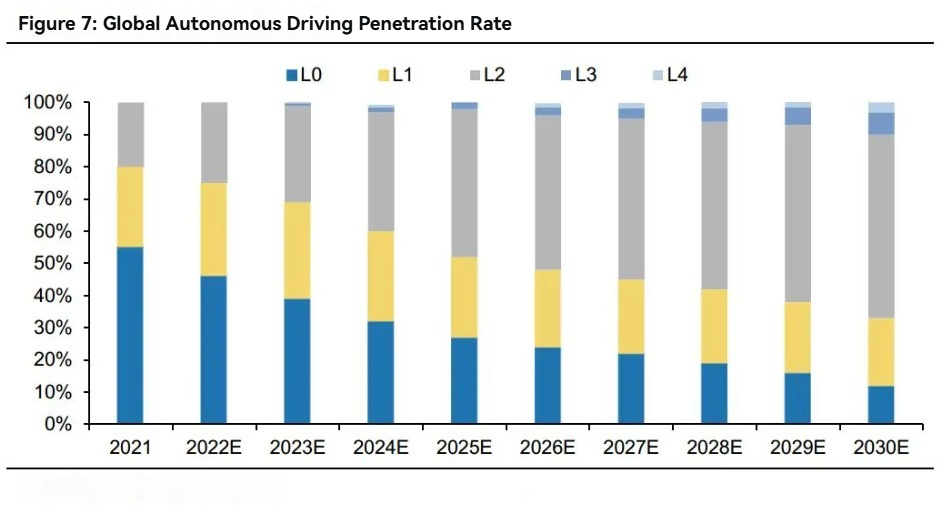

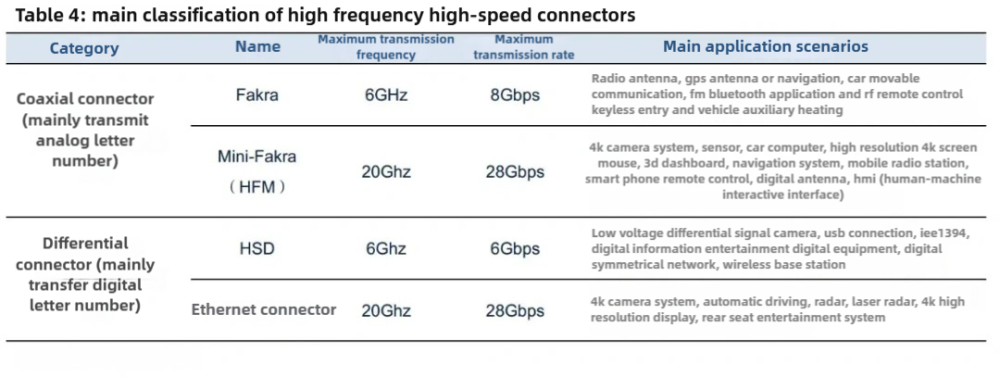

As NEVs race toward intelligence, autonomous driving and in-cabin entertainment are rewriting the rules. L3+ systems—think conditional automation—rely on 10+ cameras, multiple radars, and LiDAR, generating data volumes 100 times higher than traditional vehicles. Add 4K screens and infotainment, and the need for high-speed connectors becomes clear. Coaxial solutions like Mini-Fakra (up to 28Gbps) and differential options like HSD and automotive Ethernet (10Gbps+) are stepping up, replacing older standards like Fakra (6Gbps max).

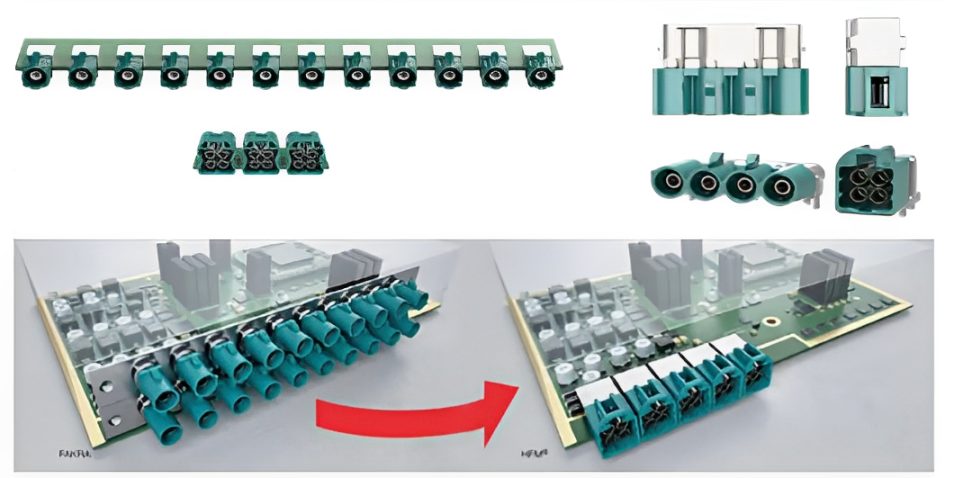

2. The Rise of Mini-Fakra and Ethernet

Mini-Fakra is outpacing its predecessor, offering 80% smaller footprints and support for 8MP+ cameras—crucial for advanced driver-assistance systems (ADAS). Automotive Ethernet, meanwhile, is becoming the backbone of in-vehicle networks, linking domain controllers with modular, lightweight designs. By 2027, Mini-Fakra could dominate high-frequency applications, with Ethernet adoption in connectors projected to jump from 20% to 50% by 2025 (industry forecasts). These shifts are accelerating NEV smarts, from lane-keeping to immersive cockpits.

The Future of NEV Connectors: Wireless and AI on the Horizon

Looking ahead, NEV connectors are poised for more disruption. Wireless charging—already hitting 11kW in trials—promises to cut physical connections, though high-power transfer remains a hurdle. AI-integrated connectors with built-in diagnostics could monitor circuits in real time, slashing maintenance costs. Sustainability is also key, with recyclable materials and energy-efficient production gaining traction to meet carbon-neutral goals. By 2030, NEVs could claim 50% of global auto sales (BNEF projection), pushing connectors to balance miniaturization, reliability, and affordability.

Connectors: Shaping the Future of NEVs?

From 800V powerhouses to smart data conduits, NEV connectors are no longer just supporting players—they’re defining the industry’s trajectory. As electrification and autonomy converge, these unsung components will fuel the next wave of innovation. What breakthroughs will they unlock in the decade ahead?